What are the transaction stages of a wine estate?

Buying a wine estate is for sure the dream of a lifetime. It is a project that is prepared upstream and takes into account various parameters including price, quality of vines and technical equipment, regularity of vineyard production, consistency of markets and reality of customers. Our various properties for sale offer the buyer the choice of orienting himself according to his wine project: production tool, wine tourism, events, lodges or bed and breakfast, hobby vineyard …

The specificity and technical nature of acquiring a wine estate in France are such that the intervention of a specialized agent is essential today. 50% of the consultants’ work is devoted to validating the property sold (the condition of the vines, the certainty of the PDO classification, the price of the estate’s wines, supervising the interventions of approved experts and participating in meetings with legal and tax specialists.

Many parameters must be checked and verified in order to draft the sales agreement which commits the two parties to complete the transaction. It is a “pre-contract” that comes before the final deed which then seals the sale definitively at the notary.

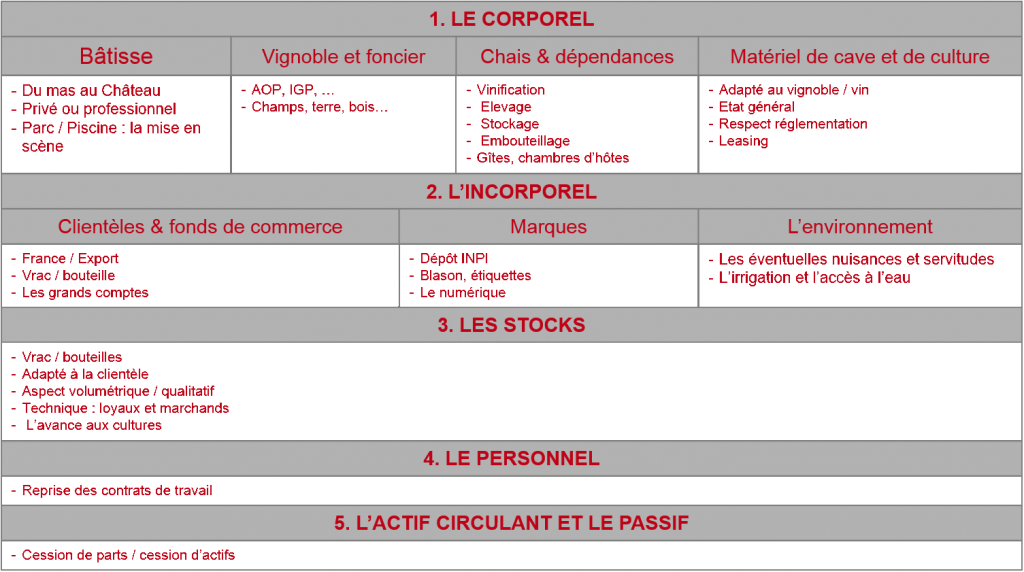

There are many things to consider when selling a wine estate.

The right people to buy a wine estate

A transaction, from the compromise to the signing of deeds, lasts between 4 and 6 months.

The simple request for an operating license takes about four months. This period is used by VINEA TRANSACTION to carry out or direct the obligatory appraisals and various checks, some of which must be carried out before the signing of any compromise.

The transaction must be formalized by qualified stakeholders, all of whom have their respective areas of expertise.

Notaries, lawyers, accountants, bankers must verify and validate, among other things: property titles, the lifting of mortgages and other privileges, notifications to organizations benefiting from a right of pre-emption (SAFER, municipality, coastal conservation, etc.) , passive and active easements, annual accounts and balance sheets, liability and asset guarantees (in the event of transfer of company shares, frequent situation in the wine industry), the lifting of conditions precedent and special conditions. The selling price must also be allocated between the bastide, the cellar and the vineyard because the depreciation conditions are very different and specificities exist depending on the wine properties, the AOCs.

All of this formatting and verification work is becoming more precise and all professional sales people must work together in the best interests of the seller and the buyer.

& nbsp;

The tangible components of a wine estate

The buildings

The building must be the subject of various audits and provide access to essential information on the general condition of the property. These mandatory real estate appraisals are established by a certified diagnostician and must be annexed to the sales agreement.

Without being exhaustive, the following main points should be checked:

- Asbestos State

- Finding risk of exposure to lead

- Parasitic state

- State of natural and technological risks

- DPE

- State of the internal electricity installation

- State of the internal GAZ installation

- Non-collective sanitation control

- Swimming pool…

As regulations are more and more strict, any breach may result in the cancellation of the sale or lead to a price revision action.

Also, over time, the buildings of the wine estates are regularly enlarged and modified, with or without respect for a building permit or the PLU. This point must therefore be verified.

The vineyard

The Hérault vineyard or the vignoble du Gard in Languedoc or the Provence , Bordeaux vineyards or Bourgogne , the realities by wine regions are very different .

The grape variety sheet must be up to date and certified by the customs services via the vineyard register which lists the plantations. The INAO certificate confirms the classification of the vines as PDO.

The vines for sale can be very different on the same wine property. Some vines may over-produce wine and others may be in recurrent wine under-production.

A GPS reading allows a metric control of the areas and verifies before the sale the area actually planted with vines. This document has no legal value.

Finally, an inventory of the health of the vineyard (mildew, flavescence dorée, etc.) must be carried out before sale.

Wine cellar

Among the various points to be checked, we find the conformity of the reprocessing of the effluents and the biological analyzes concerning the presence or not of Chloroanisoles.

& nbsp;

Cellar and culture equipment

When the equipment is taken back, a list that is as exhaustive as possible should be drawn up, mentioning the condition (good or bad) and any pledges, pledges, leases that may exist.

The intangible elements of a wine estate.

Trade and brands

For Vinea Transaction, this parameter is the most difficult to assess because it is subject to negotiation in the assessment of the overall value of the property. Assigning a value for domain awareness during a sale is always random.

It is also essential to verify the proper protection of the sold brands (INPI and website)

The different legal structures of a wine estate

Two patterns appear depending on whether the company is owned by a natural or legal person:

- Company held in its own name

The assets of the vineyard belong in their personal name to one or more owners or in joint ownership. The acquisition will take the form of a disposal of assets.

- Company owned by a legal person

Here, the assets are housed in one or more companies:

- A single structure bears both ownership and operation (GFA operator, SCEA or owner-operator SARL).

- A structure carries land assets such as SCI, GFA with development by an operating company such as SCEA, SARL … via a long-term lease.

- Some vines for sale are owned by investor and heritage GFVs.

The acquisition will then take place through a transfer of company shares.

& nbsp;

Capital gains and taxation

Nothing is more complex than studying the capital gains and taxation in the context of the sale of a wine property. Briefly, it should be remembered that in the valuations and the allocation of the price between the different assets sold, the interests of the transferor diverge from those of the purchaser. Faced with this observation, it is essential that sellers and buyers approach their notary, lawyer (legal advisor) and accountant in advance to optimize the transaction for tax purposes.

Stocks and advances to crops

Stocks of wine to buy back

The volumes of wine stocks also remain difficult to certify, given that few wineries have a leveling of their vats.

A qualitative and quantitative report of bulk and bottle stocks must be carried out. As wine is a living product, it is necessary to carry out specific analyzes (brettanomyces, ochrotoxin, etc.). Conflicting wine expertise and tastings secure both the buyer and the seller and clarify the operation.

It is also necessary to make an inventory of stocks of dry materials and phytosanitary products.

Advances to crops

The advance on crops corresponds to the costs incurred by the transferor with a view to raising the future harvest which will be for the benefit of the purchaser. As a corollary to the resumption of stocks, a quantification of advances to crops is required.

The regulations when acquiring a wine property

La Safer (Land Development and Rural Establishment Company)

It is a semi-public company. Subject to the modification of the current regulations, all rural properties in their own name or in a company are pre-emptable (if more than 51% of the shares are sold). The instruction period is 2 months.

The authorization to operate

The authorization to operate is validated with the DDTM (Departmental Directorate of Territories and the Sea) following a passage in committee of the file. The deadline is 4 months after the filing of the file by LRAR.

There is no requirement for a diploma except for young farmers.

Origin of funds

As a real estate agency we must ensure the origin of the buyer’s funds. The TRACFIN procedure was put in place to fight and prevent money laundering and terrorist financing.

The staff

The purchase of a domain involves the resumption of contracts, in particular employment contracts (labor code). A statement as precise as possible must be drawn up mentioning the seniority of the employees, the qualifications, the remuneration and the benefits in kind in accordance with the collective agreement.

It is important that on the day of the sale, relations with employees are up to date (remuneration, bonuses, paid vacation, sick leave) and any risk of labor disputes clearly announced.

In conclusion

The transaction is not limited to simple visits and agreement on the price of the vines. All of these different parameters demonstrate the importance of being well supported and guarantee the success of the sale or acquisition project. This diagram summarizes the different components that come into play during the transfer of wine properties or vineyards.

Our other buying and selling guides

- How to buy a wine estate?

- How to sell your vineyard, vineyard or vineyard?

- How to evaluate a wine estate?

- Why invest in a wine estate?

- How to manage a wine estate?

- Who buys wineries?