TYPES OF INVESTOR 7 DIFFERENT PROFILES

An exclusive study by Vinea Transaction

(March 2014)

As in previous years, the Vinea Transaction network brought its expertise to Propriétés de France, a magazine belonging to the Figaro group.

The July-August edition of the magazine featured a special report on vineyard transactions.

Propriété de France magazine, issue no. 155, JULY-AUGUST 2015

1 – THE STUDY

In order to gain an in-depth understanding of the wine property market, Vinea Transaction conducted an exclusive study. A detailed analysis was made of 159 transactions carried out between 2010 and 2013 by its network of agencies.

Although this 2014 survey is different from the study published by Vinea Transaction in 2012, it provides an interesting comparison.

REGIONS COVERED: All the French wine regions were included except Champagne (atypical market) and Alsace (not covered by the Vinea Transaction network).

SCOPE OF THE STUDY

- The study focuses exclusively on “domaines” with vineyard and buildings. Disposals of parcels of land were not taken into account.

- Chinese investors were excluded from the study because they only have an impact on Bordeaux vineyards, so their inclusion would have skewed our overall findings.

- Transactions worth over €25 million were also excluded from the scope of the study

STUDY SAMPLE: Although the study is not exhaustive, it is nonetheless a representative sample of transactions on the French wine property market. The 2014 study examined 159 transactions, representing 4,640 ha negotiated*.

Sale prices of the transactions analysed range from €0.9 million to €17 million, with an average of €3.5 million.

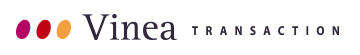

2 – TYPES OF INVESTOR: 7 PROFILES

The study revealed seven very different types of buyer, each with their own characteristics and motives. This table gives a breakdown and overview.

|

Category |

Motive for buying |

Expertise in vineyards & wine |

% of transactions by volume |

% of transactions by value |

Rising or falling? |

|

Young wine-producers |

« Their life plan » |

Professionnal |

3 % |

1 % |

Falling |

|

Neo-wine producers: Sales rep/white collar self-employed professional/corporate executive/IT |

« A career change » |

Non-professional |

21 % |

24 % |

Stable |

|

Established wine-producers |

« A quest for quality, optimising outgoings and tax liability, and asset transfer » |

Professionnal |

28 % |

20 % |

Rising |

|

Wine merchants |

« A quest for legitimacy and securing the supply chain » |

Professionnal |

10 % |

8 % |

Rising |

|

Company directors |

« Asset transfer and tax planning » |

Non Professionnal |

5 % |

9 % |

Stable |

|

European investors |

« France, wine and quality of life » |

Non Professionnal |

28 % |

33 % |

Stable |

|

Miscellaneous others |

« From dreamers to retirees » |

Non Professionnal |

5 % |

5 % |

Stable |

|

Total |

|

|

100 % |

100 % |

|

(*) Every year, almost 20,000 ha of French vineyards (out of a total 800,000 ha) change ownership.

Wine professionals prefer properties with fewer buildings (they already have what they need). This translates into lower investment figures, with 38% of transactions by volume and only 28% by value.

Non-French Buyers, accounting for 28% of transactions by volume and 33% by value, are falling slightly in number compared to the 2000s. However, their investments are more significant, on average, than those of French investors. It is clear that in the past two years France’s international image in terms of taxation has suffered: “Taxes are heavy and the tax rules are constantly being changed.”

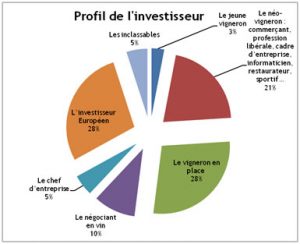

3 – TYPES OF PROPERTY SOLD

The 159 transactions in our study were conducted between 2010 and 2013, totalling overall investment of €563 million. These transactions were managed by Vinea Transaction agencies or by our observatory.

- Transactions under €2 million accounted for 57% of the total by volume, and 20.6% of investment by value.

- Transactions over €10 million accounted for just 7.5% of the total by volume, but 31% of investment by value.

- 4,640 ha of vineyards were sold during the period (159 transactions), representing an average of €121,300 per ha*.

- The average vineyard size per transaction stood at 29 ha.

(*) While the value per ha may appear high, it is important to remember that this figure includes buildings (farmhouse or château, wine storehouse and outbuildings) and equipment.

Inventory is accounted for separately.

|

Geographical location of transactions in the study |

% |

|

Loire |

4% |

|

Bourgogne / Beaujolais |

4% |

|

Languedoc Roussillon |

28% |

|

Côtes-du-Rhône |

18.5% |

|

Bordeaux |

28% |

|

Cognac |

4.5% |

|

Armagnac |

S/I |

|

Provence |

13% |

|

Total |

100% |

S/I: Statistically insignificant

TYPES OF TRANSACTION BY VALUE: FROM €0.9 M TO €17 M

|

Transaction Amount |

Number of transactions |

% |

Amount in €M |

Total en €M |

% |

|

Below €1 M |

29 |

18.3% |

0.85 |

24.6 |

4.4% |

|

€1 – 2 M |

61 |

38.4% |

1.5 |

91.5 |

16.2% |

|

€2 – 5 M |

36 |

22.6% |

3.5 |

126 |

22.4% |

|

€8 – 10 M |

21 |

13.2% |

7 |

147 |

26.1% |

|

Above €10 M |

12 |

7.5% |

14.5 |

174 |

30.9% |

|

Total |

159 |

100% |

|

563.1 |

100% |

|

Average in €M |

|

|

|

3.54 |

|

Regional investor trends (five main wine-producing regions)

There are regional differences when it comes to the dominant investor type:

- The Bordeaux and Mediterranean wine regions are more open to external investment than the Burgundy region, where a culture of secrecy reigns.

- The Bordeaux region is notable for its high number of Chinese investors.*

- The Cognac region is dominated by professional investors (wine-growers and distillers). It is also popular with Russian and Chinese investors, as well as professional investors from the wines and spirits sector.

|

|

Bordeaux |

Bourgogne |

Languedoc |

Côtes-du-Rhône |

Provence |

|

Young wine-producer |

– |

– |

+ |

+ |

– |

|

Neo-wine producer |

++ |

– |

+ |

+ |

++ |

|

Established wine-producer |

+ |

++ |

+ |

+ |

+ |

|

Wine merchant |

++ |

+ |

+ |

++ |

+ |

|

Company director |

++ |

– |

– |

+ |

++ |

|

European investor |

++ |

– |

+ |

+ |

+++ |

|

Miscellaneous others |

S/I |

S/I |

S/I |

S/I |

S/I |

(*) Chinese investors in Bordeaux vineyards

The study has been adjusted to allow for the impact of Chinese investors on the Bordeaux wine market. It shows 68 transactions were carried out between 2010 and 2013. Considering 95% of this category of investors buys in the Aquitaine region, we intentionally disaggregated the sales and only included transactions that did not involve Chinese investors.

ESTATE TYPES

The transaction value depends on the size of the building (farmhouse or historic château) and on the vineyard’s classification and reputation (from €10,000 per ha up to more than €2 million per ha, depending on appellation – see Vinea study 2012).

|

Below €1 million |

Farmhouse |

|

Between €3 million and €10 million |

Approx. 50 hectares, mansion or historic château, reputable vineyard, municipal appellation |

|

Above €10 million |

|

Transaction values are significantly higher in Bordeaux, Provence and Burgundy/Beaujolais than in Languedoc and Loire.