The neo-winemakers

TF1, has approached the Vinea Transaction network, as a great witness, for the needs of their next subject which will deal with the theme of the new winegrowers in a large format. You will be able to appreciate our testimony in the 8 o’clock news this month of June 2021.

In 30 years of activity, we have met all possible origins of investors in the vineyards: computer scientist, car dealer, brewer, musician, chemist, sportsman, company manager, startup, wine merchants…

It is estimated that 70% of investors in wine properties are French neo-winegrowers and only 3% are of foreign origin. Among the latter, there is a majority of Europeans and Americans.

The new French winemakers offer several profiles:

Business owners and “fake retirees retired from business”:

These investors have sold their company and are looking for a new challenge; they want to save on taxes and enjoy an idyllic place to live. They represent 20% of investors (source: Vinea Transaction network panel).

Very often neophytes, these company managers or merchants who have sold their business wish to make a professional reconversion by combining heritage and quality of life. Their dream is to make wine, sell it and live in a winegrower’s house, preferably in an AOC area.

A large number of industrialists or company managers who find themselves too young to take a well-deserved retirement, invest in the vineyard by optimizing a triple tax problem: the IFI, the donation and the limitation of the capital gain linked to the transfer of their original activity.

Oenophiles:

Oenophiles are always present. Although they have varying financial means and are of different ages, they generally invest in the same concept: small estates with strong oenological potential. They represent 20% of the investors. Professionally, they come from various backgrounds, mainly bankers, insurers, computer scientists…

Merchants and hoteliers:

The vineyard has been for some years the alibi for a change of life. Some merchants and hoteliers, worn out by the intensity of their profession, find in the French vineyards an enormous potential. Many of them, due to the sanitary crisis, have taken the plunge and are investing in all the wine-producing regions in an indifferent way.

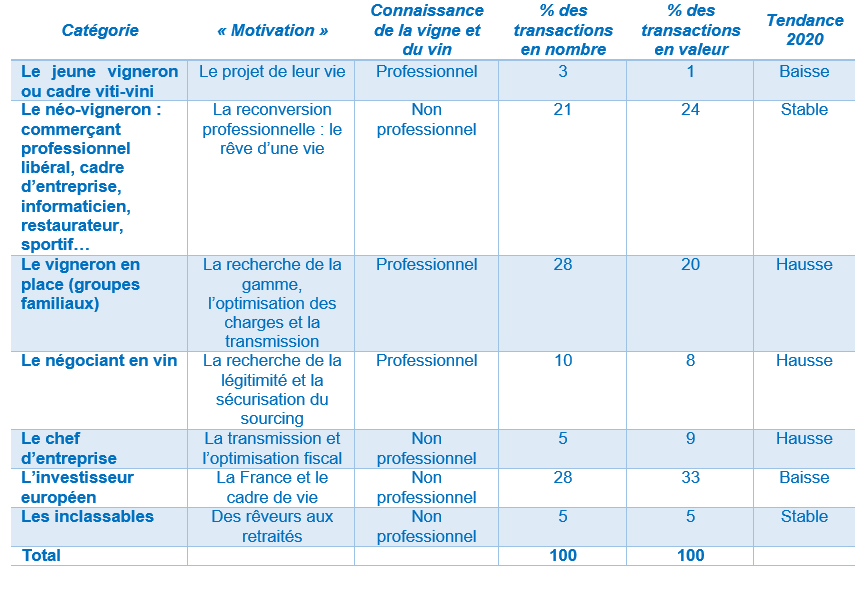

In conclusion, different groups with very different origins and motivations are illustrated and summarized in the table below.

Each year, out of the 800,000 hectares of French vineyards, nearly 20,000 hectares change hands.

The Vinea Transaction network, which celebrates its 30 years of know-how, has been used as a great witness for a report realized by TF1 which will be broadcasted during the 8pm news in June 2021. A strong testimony will be developed through one of the neo-winegrower clients installed by Vinea Transaction, Matthieu Ponson of Domaine de Piéblanc in Gigondas.

And tomorrow, who will be the new winemakers?

Far from being a fad, it is clear that the investments made by the neo-winegrowers will continue over time.

The health crisis has created vocations and generated an acceleration towards the concepts of nature and rurality.

Today, three trends are emerging both in France and worldwide:

The hobby vineyards :

Not to be confused with garage wines, these small properties combine living space and hobby wine. It is the pleasure of owning a beautiful house with a land reserve of 10 hectares and a small vineyard of 2 to 4 hectares. The project is to live well, to make wine for friends. The approach focuses on small areas of AOC land for sale offering a true wine estate configuration. In an estate concept, the neo-winegrowers can pursue telecommuting activities without any difficulties.

Multi-activity areas:

The acquisition of this type of property will give investors the opportunity to diversify their income through activities other than wine (wine tourism or “resorts” for nature, wine and health, equestrian activities…).

Semi-industrial properties:

This term is far from being pejorative, and this concept results from the strategies of the New World vineyards. This type of development is already underway for certain houses (e.g. Grands Chais de France, whose vineyards cover 1,800 hectares in the Languedoc region, notably in the Hérault and Bordeaux). Concepts that combine properties in the plural and the family concept (the Perrin de Beaucastel family, owner of some fifteen estates in the Côtes du Rhône, or Bernard Magrez, owner of thirty properties in French vineyards, particularly in Bordeaux and abroad). For the latter two groups, the aim is to reach a strategic size in order to complete and enrich their range, to develop their sales, to secure their supplies and the quality of their wines.

New winegrowers or new winegrowers, acquiring a wine property is a dream that you wish to realize, but what are the advantages of this atypical investment? How to approach the research, the financing, the renovation of the house, the cellar and the vineyard, which type of company to create, how to compensate for its technical deficiencies? The Vinea Transaction network is here to answer your questions and find quick and efficient solutions to help you realize your project in all serenity.

To succeed intelligently in a professional reconversion by proposing an exceptional place to live, a safe investment and an efficient work tool, such is the vocation of the agencies and providers of the Vinea Transaction network.